by Lowell Ponte

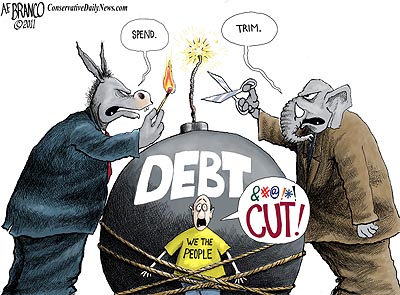

America’s combined government and personal debt just hit $41 Trillion, equivalent to $329,961.35 per household – the greatest debt of a nation and its people in human history.

But why worry? Treasury Secretary Steven Mnuchin says that by September 29th the government will run out of money and be unable to pay its bill. But by then Congress – unable to reduce its addictive spending – will raise the debt ceiling so politicians can borrow and print trillions more.

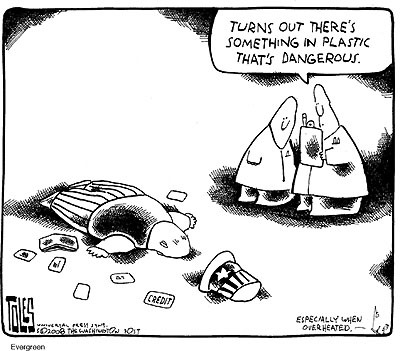

And private sector citizens – almost half of whom, as we discussed last week, live paycheck to paycheck and do not have $400 in savings to pay for an emergency – have likewise seen their average FICO credit score, their personal “debt ceiling,” raised to 700.

Roughly 70 percent of America’s Gross Domestic Product (GDP) comes from consumer spending, and most of the rest comes from government spending. With infinite credit, what could go wrong?

In this human-made Eden of ever-expanding credit, some have begun to notice odd things. Why has the credit card company VISA started bribing merchants to accept only plastic, and never cash, in customer payments?

Banking giant JPMorgan Chase, reports ZeroHedge, “has banned cash payments for credit card debt, mortgages, and car loans. It has also banned the storage of ‘any cash or coins’ in safe deposit boxes.” Your bank is now required to spy on you by the government.

The European Union (EU), along with President Barack Obama, endorsed the radical legal doctrine of the “bail in” – that your bank account actually belongs to your bank, not you, and can be seized to pay the bank’s debts. But now the EU is proposing account freezes that could prevent you from withdrawing your money. (In the U.S., Attorney General Jeff Sessions favors civil asset forfeiture of “suspicious” cash a person possesses.)

The serpent in this Eden has a name – “financialization,” the transformation of our economy from the making of goods and services to the conjuring of wealth by speculation, leverage, and the manipulation of interest and money.

President Dwight Eisenhower warned Americans of the “military-industrial complex,” as Craig R. Smith and I explored in our 2016 book Money, Morality & The Machine. In the economic crisis of 2008-2009, America experienced a “quiet coup” d’etat, we quoted a former chief economist of the International Monetary Fund as saying.

In that coup d’etat, said Simon Johnson, “the finance industry has effectively captured our government.” The international banks, and the money and credit manipulators have surpassed even the defense industry in controlling the best government that money can buy.

How much “wealth” do the forces of financialization wield in our world? No one can be sure, but in just the trading of derivatives – mostly futures contracts based on interest rates, Treasury bonds, foreign currencies, and similar things – the best estimate is that yearly trading in the past has reached at least $1.2 Quadrillion. That’s 1.2 Trillion dollars multiplied by 1,000. Such a debt bomb can never be paid, only detonated or debased.

No wonder the financial serpents push so hard to rule a globalized system based on a “cashless” economy and credit that can be conjured in any amount out of thin air. And no wonder that working people here and in Europe feel pushed to the brink by a system that chokes their income, provides high-interest credit serfdom instead, and sends prices into the stratosphere.

This is why the United Kingdom voted to exit the European Union, and working Americans voted for populist nationalist President Donald Trump. It’s why wise people build their future not out of paper currency, but with hard metal and bedrock values that can survive financialization’s crash.

————————————————————————————————————————————–

To schedule a fascinating interview with Lowell Ponte, contact: Sandy Frazier at 516-735-5468 or email sandy@mystic-art.com.

For a free copy of Money, Morality & The Machine (see pages 86-89 for our Simon Johnson coup d’etat discussion) or the new “Crisis Timeline,” contact: David Bradshaw at 602-918-3296 or email him at ideaman@myideafactory.net